About Federated Funding Partners

Table of ContentsFederated Funding Partners Can Be Fun For EveryoneFederated Funding Partners Fundamentals ExplainedThe 9-Second Trick For Federated Funding PartnersRumored Buzz on Federated Funding Partners

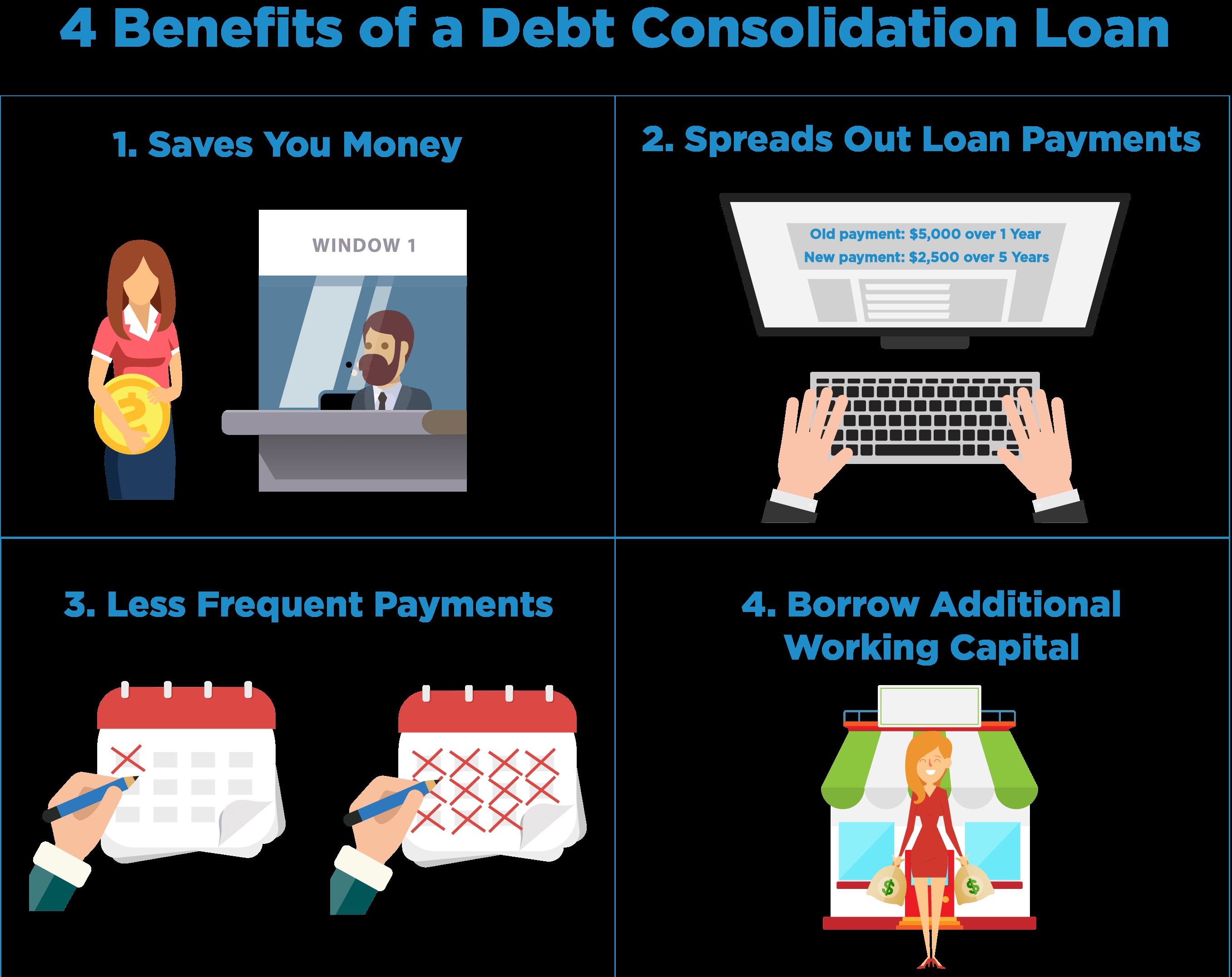

If the financing term is longer than you want it to be, if the passion price varies and you would certainly like taken care of, if your finance is protected as well as you prefer to it not be connected to collateralthese are all factors that may merit financial debt loan consolidation. There are numerous finances to combine financial obligation, yet some might have their disadvantages.Some people taking into consideration a personal funding feel bewildered by having several debt repayments monthly. A personal finance might lighten this load for two reasons. For one, it may be feasible to lower the passion paid on the debt, which implies it's potentially feasible to save cash in passion over time.

If it's feasible to get lower passion than you have on your current financial obligation, or a shorter term on your financial debt to pay it off faster, an individual car loan might be worth looking right into. On the various other hand, you'll additionally intend to be cautious concerning costs that could feature your new finance, separate from the passion price you'll pay.

Financial Debt Consolidation for Student Fundings It's possible to consolidate student car loans like other types of financial obligation. If you have only government pupil financings, you can settle them with a Straight Loan Consolidation Car Loan.

Some Known Incorrect Statements About Federated Funding Partners

Straight Debt consolidation fundings still get approved for lots of government funding securities and programs. Debtors with both personal as well as federal lendings are able to roll them all into one re-financed car loan with an exclusive loan provider. Trainee lending refinancing can possibly allow you to get approved for a reduced rate of interest than the government lending consolidation program.

If you are unable to meet numerous charge card repayments as your passion repayments increase or if you merely wish to move from a credit score way of life to a financial savings way of living, it may be time to consolidate your credit card repayments so you can remove your credit card debt. Financial debt loan consolidation suggests to bring every one of your balances to a solitary costs and also it can be a helpful method to manage your debt.

Know your present credit score financial obligation standing The first action is to analyze just what you owe and what your monthly take away income is. Begin tracking what you owe and what you gain, to obtain a handle on what's coming in, going out, as well as just Go Here how much is left over on a month-to-month basis.

Some Known Details About Federated Funding Partners

Ways to settle your credit scores card financial debt Inspired by your understanding of your funds, you can start to pick the financial obligation combination method that works finest for you. Financial obligation counseling services You might likewise locate many options through debt therapy solutions, something many individuals look to when they see that their credit score card financial obligation surpasses their revenue.

As soon as you dedicate to a repayment strategy, your financial obligation counselor may be able to help stop financial debt collection letters as well as calls (federated funding partners). Fulfilling the settlement terms that a financial debt counselor collections may improve your credit report. Negative aspects of financial debt counseling services: Until you settle your financial obligations through the accepted financial obligation counseling consolidation strategy, you usually will not be able to open up or make an application for any kind of new credit lines or finances.

Snowball method vs. avalanche technique There are two recommended methods to attack bank card financial obligation by yourself: the snowball method as well as the avalanche approach. If you have see this here tracked your debt card balances, minimal repayments, as well as APR, either approach is simple to comprehend: The snowball approach aims to pay all credit scores card equilibriums at their minimal month-to-month payments however then recommends that you include any kind of other available funds to settle your credit score card with the largest balance.

With either technique, when you have actually fully settled either the card with the largest balance or the card with the highest APR, you reserve that same regular monthly settlement and also guide it at the next charge card in line. This strategic technique can assist debtors with he has a good point lots of charge card, minimizing the bigger trouble cards (bigger equilibrium or larger rate of interest) initial and afterwards rotating in the direction of the next-biggest issue card: combining your financial obligations as you go.

Getting The Federated Funding Partners To Work

DIY financial obligation consolidation is wonderful for those who feel they can afford a project to pay off their financial obligation, while still accruing rate of interest charges on their existing equilibriums. But it may not function if you are already struggling to satisfy minimal repayments or your credit scores card equilibriums. DIY financial obligation loan consolidation needs unwavering determination to pay off bank card equilibriums, and a capability to consistently track as well as manage budget plans and also finances.

Credit score card equilibrium transfer Transferring your equilibriums can be a means to reduce the interest repayments from your current bank card, but any type of equilibrium transfer need to be made with terrific treatment. If you recognize your existing charge card' APRs, it ought to be simple to determine a brand-new bank card that offers both (1) a lower APR and (2) a capability to transfer existing equilibriums (federated funding partners).